Being Wise With What's Given To You

Monday, March 22, 2010 at 9:00AM

Monday, March 22, 2010 at 9:00AM  MAD21

MAD21 By MAD21

"One man gives freely, yet gains even more; another withholds unduly, but comes to poverty." (Proverbs 11:24)

"One man gives freely, yet gains even more; another withholds unduly, but comes to poverty." (Proverbs 11:24)

"Each man should give what he has decided in his heart to give, not reluctantly or under compulsion, for God loves a cheerful giver." (2 Corinthians 9:7)

We are told not only to give and give cheerfully, but we are also told to plan it out.

Faith,

Faith,  Family Life,

Family Life,  Finances,

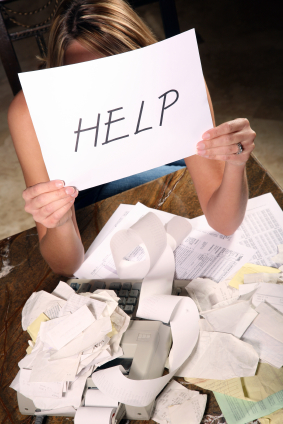

Finances,  Help,

Help,  Wisdom in

Wisdom in  Family Life,

Family Life,  Finances

Finances